Explain Different Kind of Share Capital

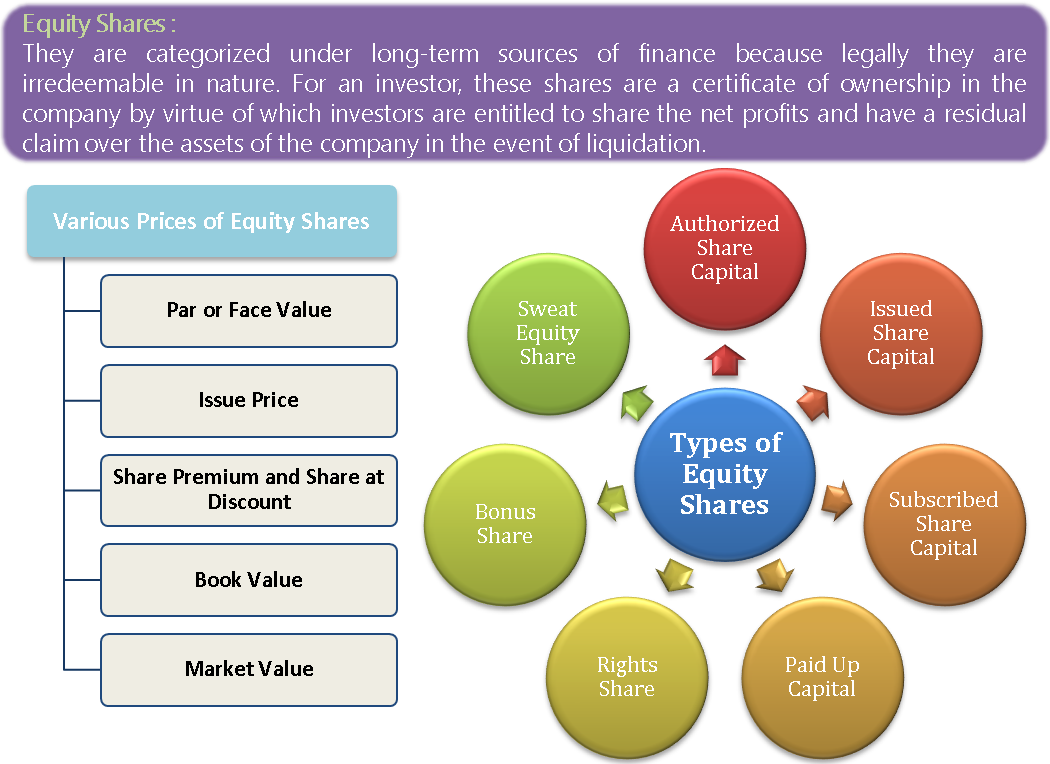

It represents that part of total authorized share capital which has been issued by a company for subscription. A Equity share capital-.

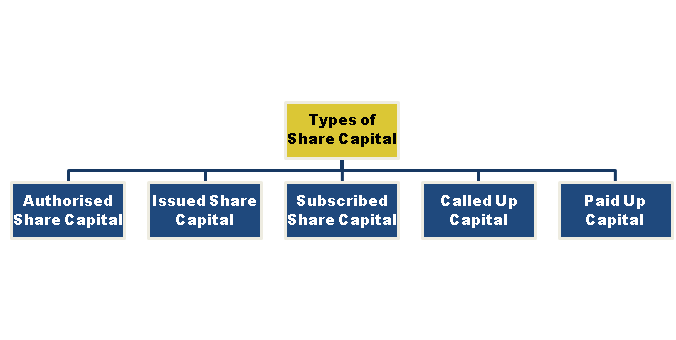

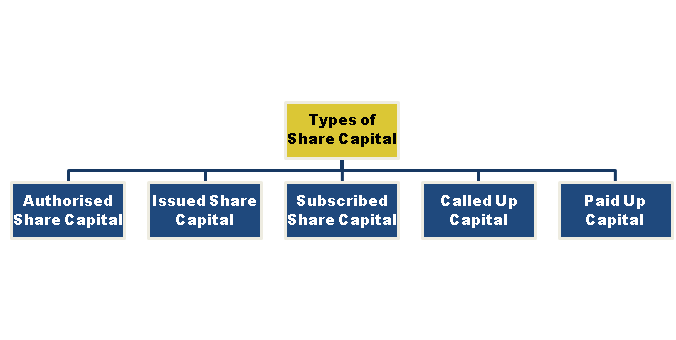

Share Capital Kinds What Are The 5 Kinds Of Share Capital In India

There are two types of shares in the share capital viz.

. The term capital in relation to a company can be broadly divided into four kinds. Shareholders are entitled to any profits that the company may earn in the form of dividends. 120000 would be uncalled capital.

Authorised nominal or registered capital. The funds raised in lieu of the shares is called share capital. Share capital is a major line item but is sometimes broken out by firms into the different types of equity issued.

Authorized share capital refers to the total capital that a company is authorized to accept from investors. They are as below. The characteristics of common stock are defined by the state within which a company incorporates.

What are the Different Types of Share Capital. Authorized Share Capital is the total Capital that a company accepts from its investors by. The share capital of a company limited by shares shall be of two kinds only namely-.

Equity Capital It consists of equity shares and denotes the capital raised by the issue of equity shares. 02- No burden on a companys resources. The preferential share capital is that part of the Issued share capital of the company carrying a preferential right for.

I With voting rights. Authorized Share Capital The total capital that a corporation accepts from its investors by issuing shares that are listed in the firms official documents is known as authorized share capital. Since the dividend is to be paid out of the profit of the company therefore they impose no load on the resources of a company.

Read on to know more. It is referred to as that part of the called up capital that is actually been paid by the shareholders. Companies that issue ownership shares in exchange for capital are called joint stock companies.

Though many promoters and investors contribute varying sums to the Companys capital yet there is no separate Capital account for each investor or promoter. Nominal capital is divided into shares of a fixed amount. The Memorandum of Association of every company has to specify the amount.

Issued Share Capital is the part of Authorized Share Capital issued to the public for. Preference Equity Differential Voting Right DVR shares are the three primary types of shares. Rs2 per share on allotment and Rs.

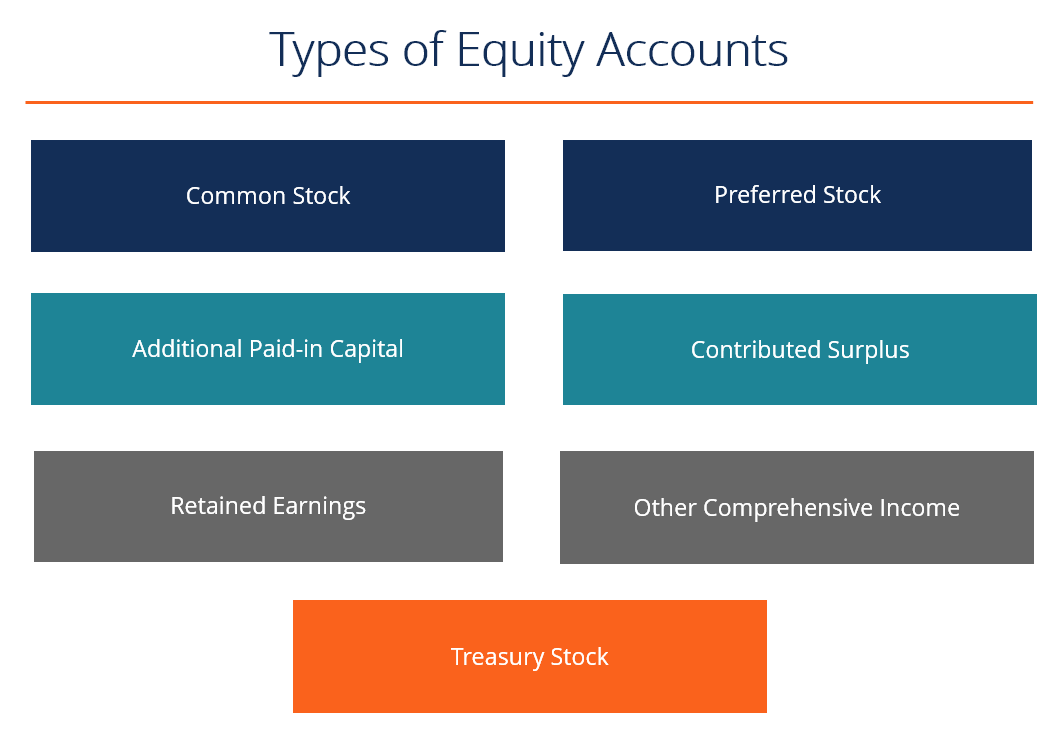

In an event of non-payment of a called up amount by shareholders it is referred to as calls in arrears. There can be common stock and preferred stock which are reported at their par value or face value. Note that some states allow common shares to be issued without a par value.

The company may not issue the. Below given are the different types of share capital. I Authorized registered or nominal capital.

Thus Rs6 321 per share which amounts to rs180000 is the called up capital of the company and the balance or Rs. 1 on the first call. This is the amount of capital with which the company intends to get itself registered.

A share is a unit of capital that a company uses to start or expand its operations. Called up capital and paid up capital will be equal when all the shareholders have paid the call amount. The share capital of the company will increase with the issuance of new shares.

Out of 300000 shares of Rs. As per Section 43 of the Companies Act 2013 shares can be broadly classified into two types Ordinary equity shares Preference shares Both these types of shares vary in regards to share in profitability voting rights as well as a settlement of capital when a company is winding up or is being liquidated. 10 each subscribed the company may call rs3 per share on an application.

Preference Share Capital It consists of preference shares and denotes the capital raised through the issue of preference shares. Every company has to specify the amount of capital it wishes to register within its Memorandum of Association. The two types of share capital are common stock and preferred stock.

This is the amount of share capital which a company is authorized to issue. The amount thus stated is termed as registered authorised or nominal capital. Registered Authorised or Nominal Capital.

Kinds of Share Capital Source. In other words the share capital of the number of shares which are taken over by the public is called subscribed capital ie the portion of issued share capital which is paidsubscribed by the shareholder is known as subscribed capital. 01- Venture capital.

There are two general types of share capital which are common stock and preferred stock. Equity Shares are the most important and popular type of shares. Preference shares and equity or ordinary shares.

Share capital is of two types namely equity share capital and preference share capital. It is therefore called the venture capital of the company. Ii with differential rights as to dividend voting or otherwise in accordance with such rules and subject to such conditions as may be prescribed.

It must be set out in the memorandum of association. Equity share capital is generated by raising of funds from the investors and preference share capital is obtained by the issuance of preference shares. It refers to that.

Types of Share Capital. B Preference share capital. The different types of share capital are as follows.

The share capital of company may be of the following types. WealthVidya According to Section 43 of the Companies Act 2013 the share capital of a company is of two types. Types of share capital.

A share represents a unit of equity ownership in a company.

Types Of Equity Accounts List And Examples Of The 7 Main Acocunts

Share Capital Kinds What Are The 5 Kinds Of Share Capital In India

No comments for "Explain Different Kind of Share Capital"

Post a Comment